working capital turnover ratio ideal

Working Capital Turnover Ratio Rs 1150000 Rs 400000. While analyzing a company this ratio is compared to that of its peers andor its own historical records.

Working Capital Turnover Ratio Formula And Calculator

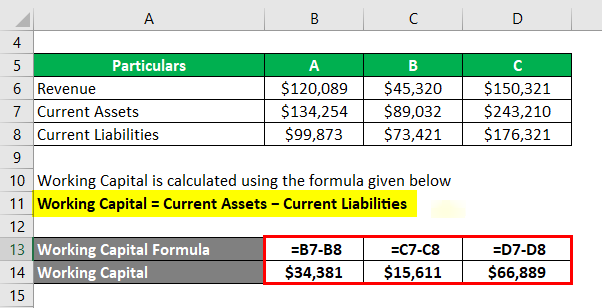

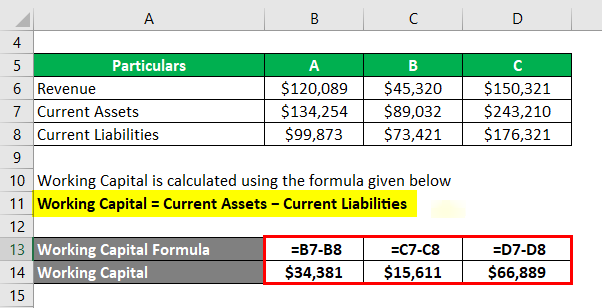

Working Capital Current Assets - Current Liabilities.

. Hence the Working Capital Turnover ratio is 288 times which means that for every sale of the unit 288 Working Capital is utilized for the period. Generally a working capital turnover ratio of 10 means that the company has generated sales of the same value as its working capital. Ideally the higher the working capital turnover ratio of the business is the better it is considered.

15000050000 31 or 31 or 3 Times. In this formula the working capital is calculated by subtracting a companys current liabilities from its current assets. Alerting concern at the right time.

All else being the same Superpower Inc. Ad HSBC Has a Range Of Solutions To Help You Self-Fund Growth Expand Your Business Reach. Working Capital Turnover Ratio 288.

This means that for every 1 spent on the business it is providing net sales of 7. Compute working capital turnover ratio of Exide from the above information. The working capital turnover ratio is thus 12000000 2000000 60.

Working Capital Ratio for Villian Corp 1M500K 2 times 2x. Current Assets 10000 5000 25000 20000 60000. Capital Turnover Ratio 500000 40000 125.

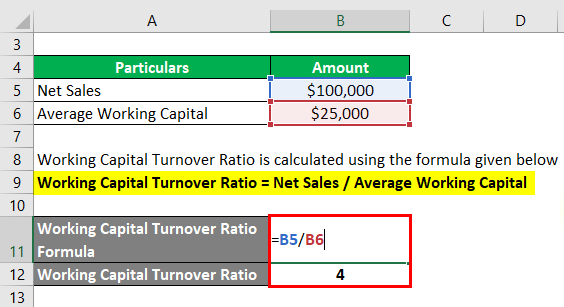

Net sales average working capital working capital turnover ratio. This concludes our article on the topic of Working Capital Turnover Ratio which is an important topic in Class 12 Accountancy for Commerce students. Net Working Capital Current assets Current liabilities.

Working capital is current assets minus current liabilities. Working Capital Turnover Ratio Net Annual Sales Total Assets Total Liabilities Working Capital Turnover Ratio Examples. The working capital turnover is preferred to be above 10 or at least equal to it.

Working Capital Turnover Ratio Net Annual Sales Working Capital. It means each of capital investment has contributed 125 towards the companys sales and this 125 seems that the utilization of capital investment is done efficiently by the company. 1M200K 5 times 5x and.

Here the working capital formula is. Company B on the other hand had 750000 in sales and 125000 in working capital resulting in a. This shows that for every 1 unit of working capital employed the business generated 3 units of net sales.

Working capital Turnover ratio Net Sales Working Capital. The working capital turnover ratio. Check out our trade and receivables financing options.

Working capital turnover Net annual sales Working capital. 300000140000 214 Average working capital. To bring context and to see why this metric is so important for measuring business.

Therefore the working capital ratio for XYZ Limited is 50. Current Liabilities 30000. What is the Working Capital Turnover Ratio.

500K to produce the same amount of sales. Company As working capital turnover ratio is 10 which means the company spent that 75000 ten times to generate its 750000 in sales. Based on the formula above Working Capital Ratio for Superpower Inc.

Working Capital Turnover Ratio Cost of Sales Net Working Capital. 420000 60000. The working capital turnover ratio will be 1200000200000 6.

A working capital turnover ratio of 6 indicates that the company is generating 6 for every 1 of working capital. Working Capital Turnover Ratio Net SalesWorking Capital. Working Capital Turnover Ratio Turnover Net Sales Working Capital.

Working Capital Current Assets - Current Liabilities. WC Turnover Ratio Revenue Average Working Capital. The average working capital during that period was 2 million.

Working Capital Turnover Ratio Formula. Is generating Sales of 1M with a working capital of 200K but it is taking Villian Corp. The working capital turnover ratio measures how well a company is utilizing its working capital to support a given level of sales.

The working capital turnover ratio is an effective way that companies use to weigh the effectiveness of their working capital in improving sales and ultimately the companys profits. The complete information needed to calculate the average working capital is available from the beginningclosing balance sheets. The formula to measure the working capital turnover ratio is as follows.

This means that every dollar of working capital produces. While having a higher working capital turnover ratio is better than a lower one there is a serious cause for concern if your ratio gets too high. An extremely high ratio 80 indicates your company does not have enough capital to support its sales growth and thus is a cause for concern.

A high turnover ratio indicates that management is being extremely efficient in using a firms short-term assets and liabilities to. 240000 140000 280000 1000002. For example if a company 10 million in sales for a calendar year 2 million in working capital its working capital turnover ratio would be 5 million 10 million net annual sales divided by 2.

Working capital can be calculated by subtracting the current assets from the current liabilities like so.

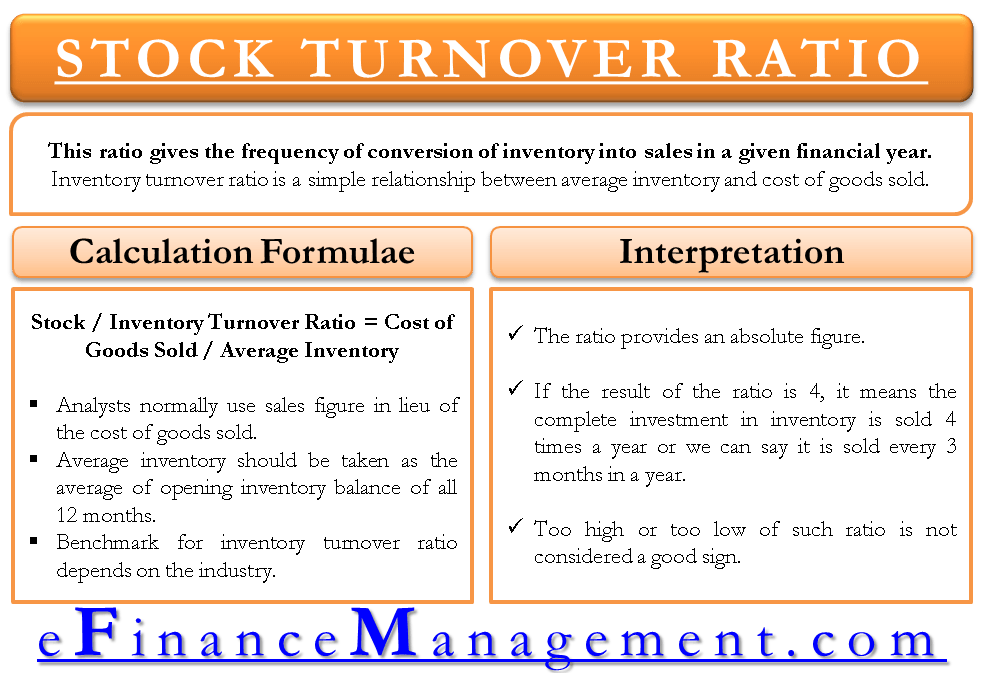

Stock Inventory Turnover Ratio Calculate Formula Benchmark

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Formula And Calculator

Working Capital Turnover Efinancemanagement Com

Activity Ratio Formula And Turnover Efficiency Metrics

How To Calculate Working Capital Turnover Ratio Flow Capital

Asset Turnover Ratio Formula And Excel Calculator

Working Capital Turnover Ratio Meaning Formula Calculation

How To Analyze Improve Asset Turnover Ratio Efinancemanagement

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio Different Examples With Advantages

Working Capital Turnover Ratio Meaning Formula Calculation

Working Capital Turnover Ratio Formula Calculator Excel Template

Working Capital Turnover Ratio

Capital Turnover Definition Formula Calculation

Inventory Turnover Ratio Learn How To Calculate Inventory Turns

Working Capital Turnover Ratio Different Examples With Advantages